How to use market turbulence measurements?

Main assumptions

- We can predict future path of market turbulence, since market turbulence can persist across time

- We can try to avoid risky assets during these turbulent periods and therefore save money

Financial turbulence indicator

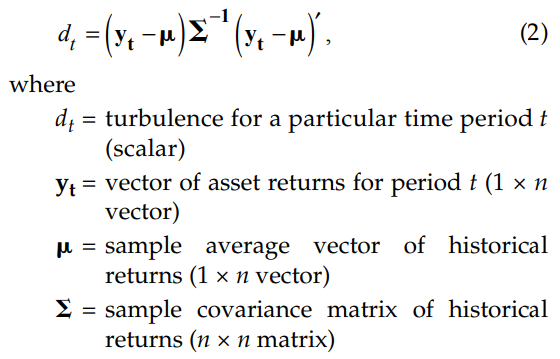

Kritzman and Li (2010) present “a mathematical measure of financial turbulence” based on the Mahalanobis Distance.

Qualitatively: financial turbulence is a condition where

- Asset prices move by an uncharacteristically large amount.

- Asset prices movements violate the existing correlation structure (the “decoupling of correlated assets” and the “convergence of uncorrelated assets”).

- If both conditions are satisfied, turbulence will be higher than if only one of the conditions are satisfied.

This chart is useful to objectively assess current market turbulence conditions.